FinOpX - Enabling Smart Financial Processes

FinOpX is the ultimate solution for financial institutions that aim to revolutionize their lending, collection, and CRM processes. It helps to automate and catalyze the onboarding process for various financial services like bank account opening, credit card issuance and management, credit disbursement, etc. Dynamic frameworks created for underwriting processes are powered by AI and ML. They support in-built integrations with APIs like Karza and Twilio, OCR, and KYC validation.

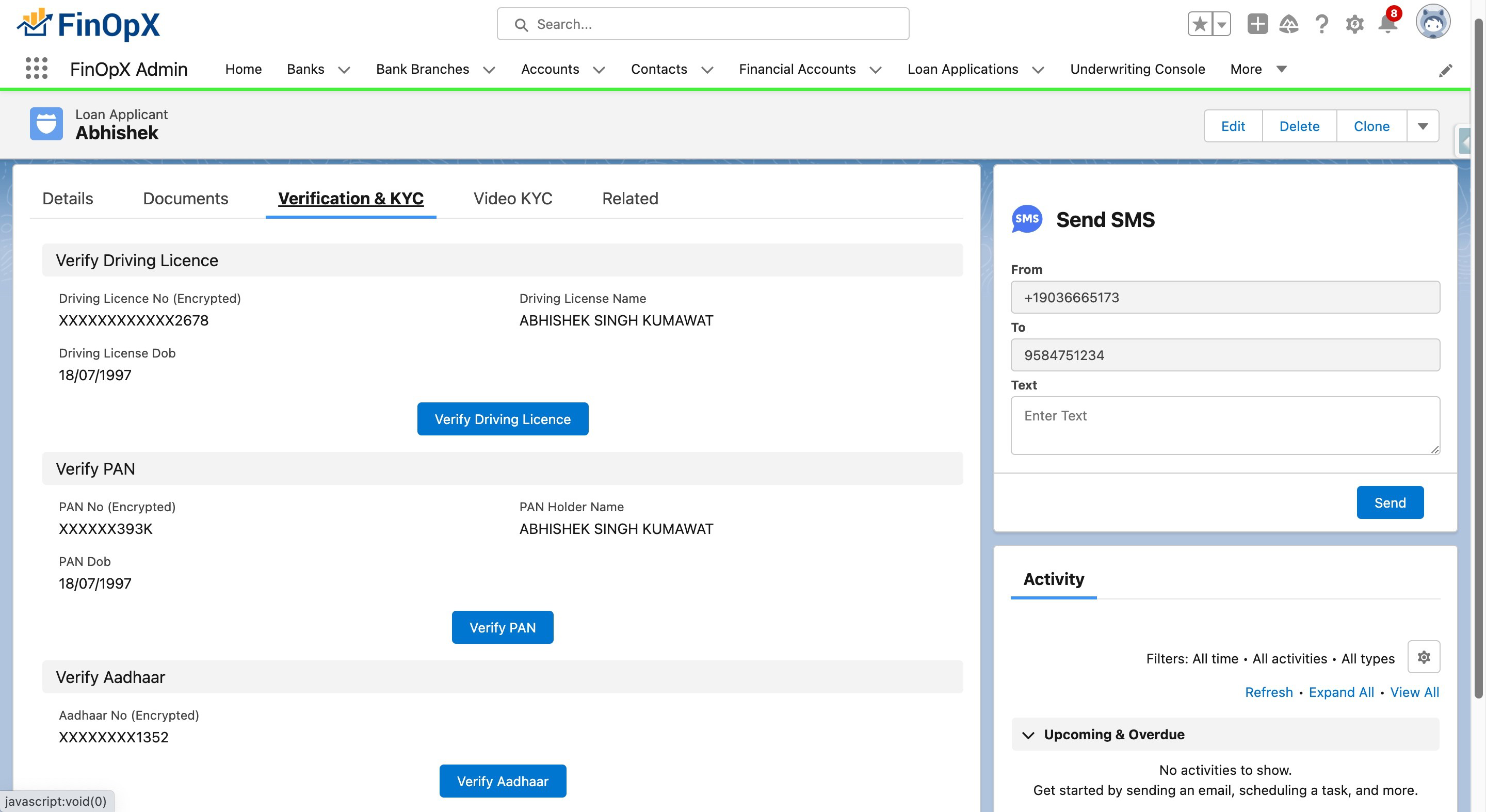

The omnichannel loan origination system by FinOpX automates the loan application process across multiple channels and makes informed decisions about issuing or disapproving loans. The automated pre-screening checks set up for KYC, CIBIL score, and OCR validation accelerate the loan application and disbursement process. Moreover, it is possible to integrate the automated customer onboarding framework with any banking product or service. Thus, FinOpX is a complete solution for the financial services industry.

Functionalities

CRM Features

- Account management

- Lead management

- Document management

- Task management

Operations & Processes

- Omnichannel loan origination

- Customer onboarding journey

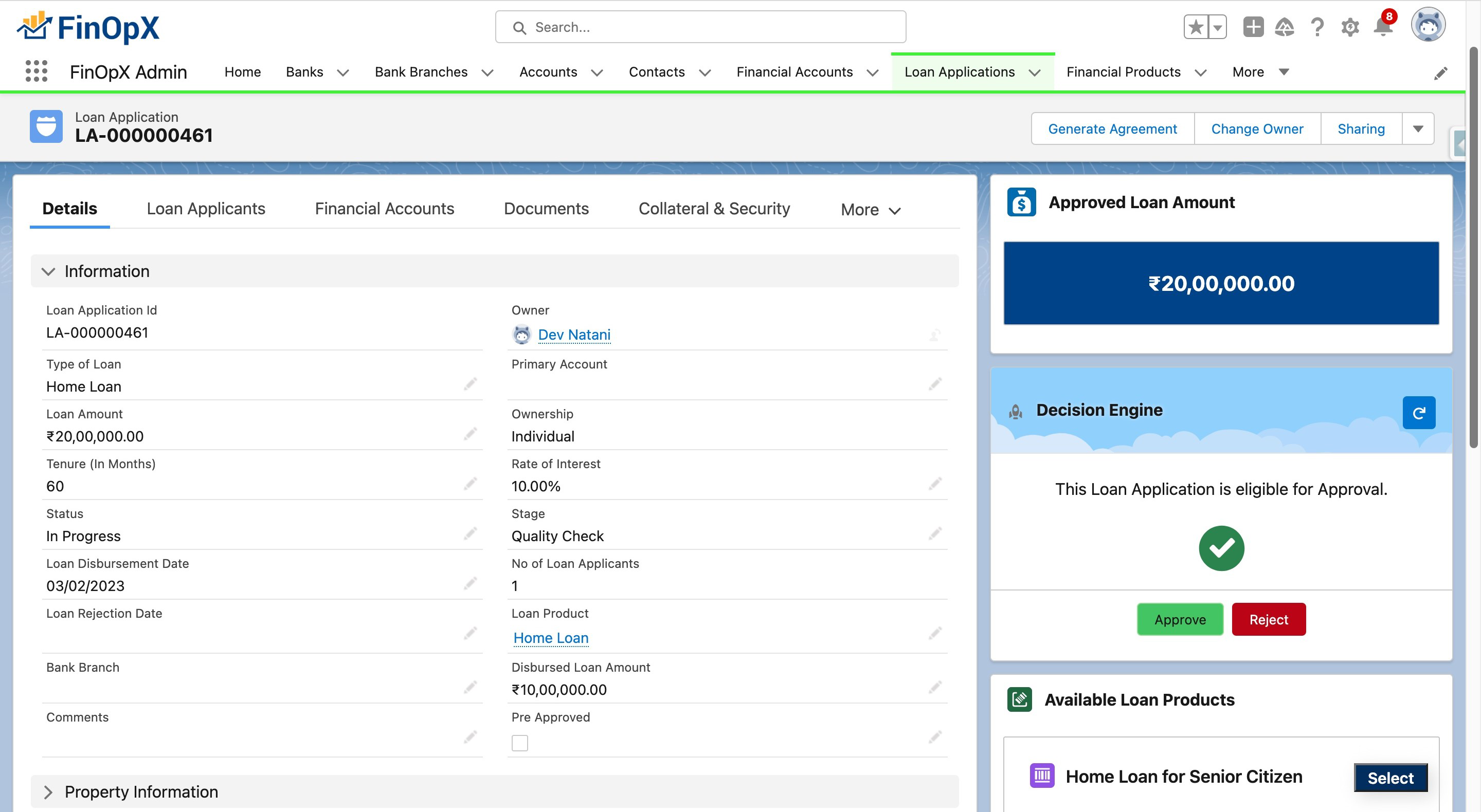

- Loan application processing

- Automated pre-screening checks

- OCR solutions

- Risk assessment and modelling

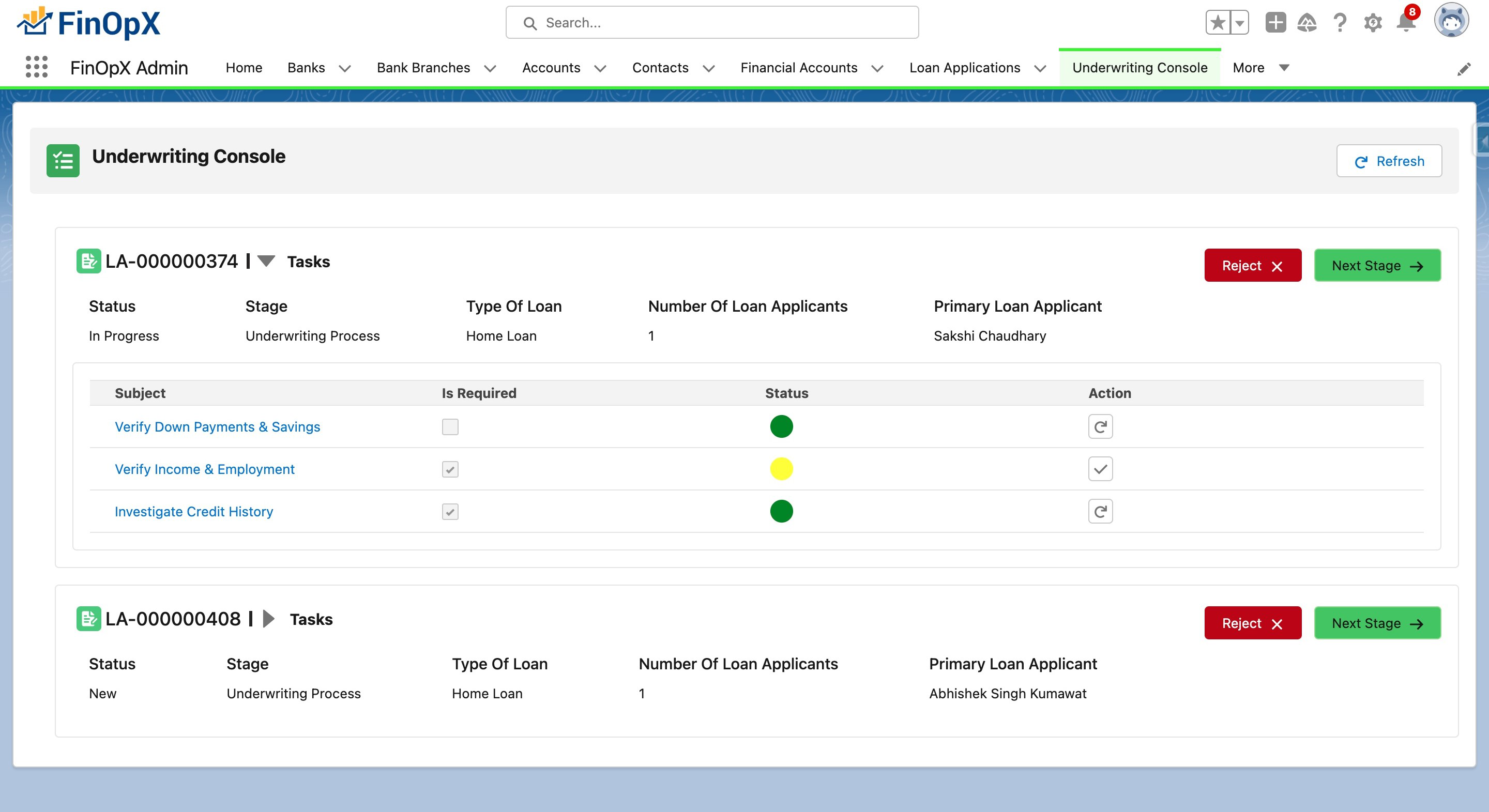

- Underwriting process

- Automated decisioning

- Automated action plans

- Security and collateral management

- Financial account management and automated payment reminders

- Visit planning and execution for collection

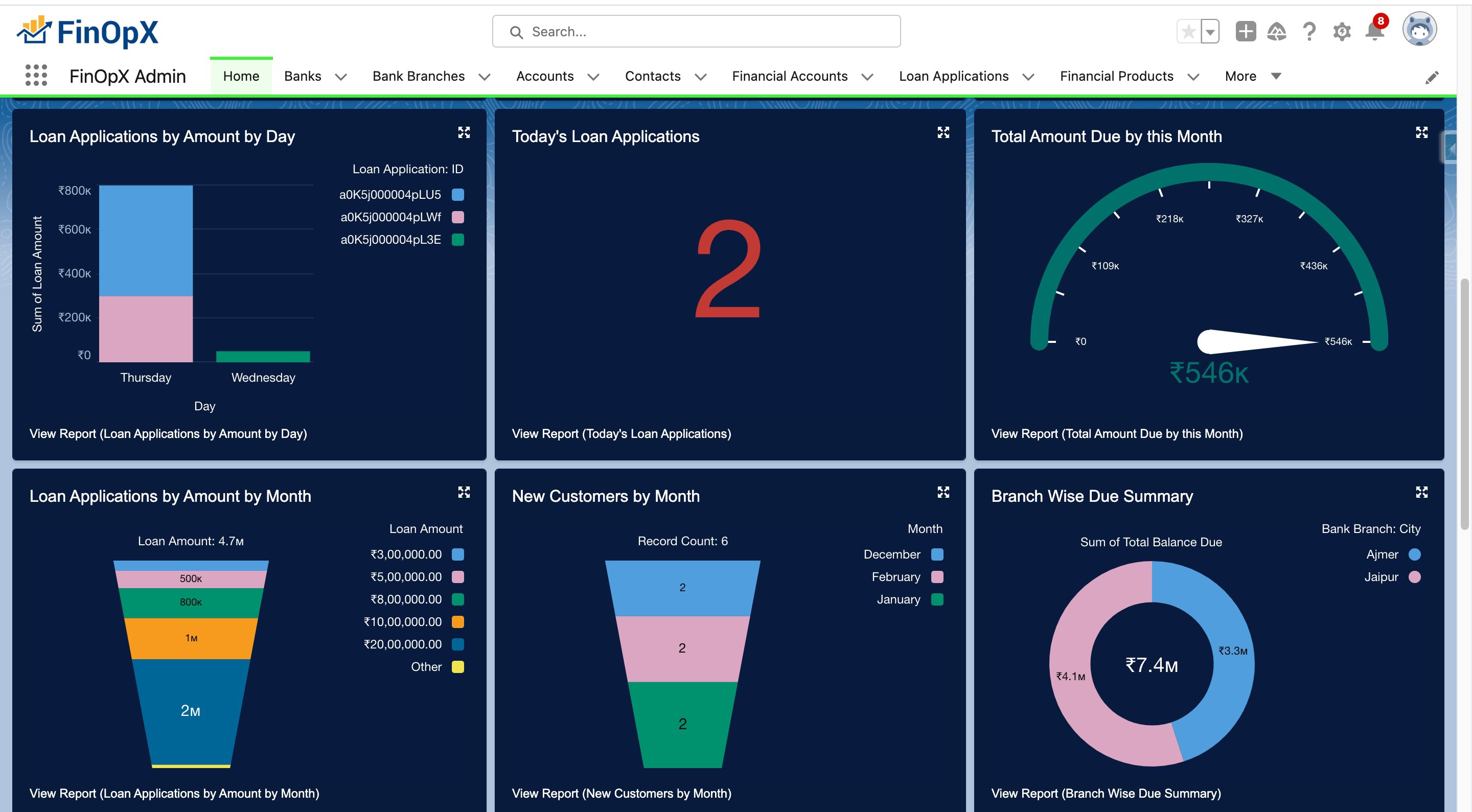

Analytics

- Customers with overdue EMI

- New customers by month

- Approved loan applications by month

- Rejected loan applications by month

- Loan application by status

- Day-wise collection

- Branch-wise due summary

- Total interest earned by month

- Branch-wise collection

Why Choose FinOpX?

- Digital Customer Onboarding

Onboard your customers digitally 10x faster using video KYC. - Faster Decisioning

Make automated smart decisions on loan applications with a Dynamic Rule Engine Framework. - 360° View of Customer Profile

Give your employees a complete and consolidated view of the customer profile at one place, from offers to transactions, to life events and goals. - Personalized Offers for Customers

Delight your customers with offers recommended by Einstein and Rule Engine. - Simplify Your Payment Process

Effortless EMI collection and timely notifications and reminders.

Technologies Used

- Salesforce Platform

- Sales Cloud

- Service Cloud

- Experience Cloud

- Custom Objects, Apex Triggers & Classes

- Lightning Web Components

- Lightning Flows

- Reports & Dashboards

- Einstein

- Integrations (Karza, Twilio, OCR etc.)

Installation Process

Powered by the Salesforce Platform, FinOpX can be installed as a managed package.

See it in Action